Editor's Note Private equity firms are accelerating their push into outpatient cardiology, lured by reimbursement trends and a fragmented market but shadowed by concerns about patient outcomes and financial motives, Modern Healthcare October 16 reports. Investor activity in cardiology has surged alongside the Centers for Medicare & Medicaid Services (CMS)…

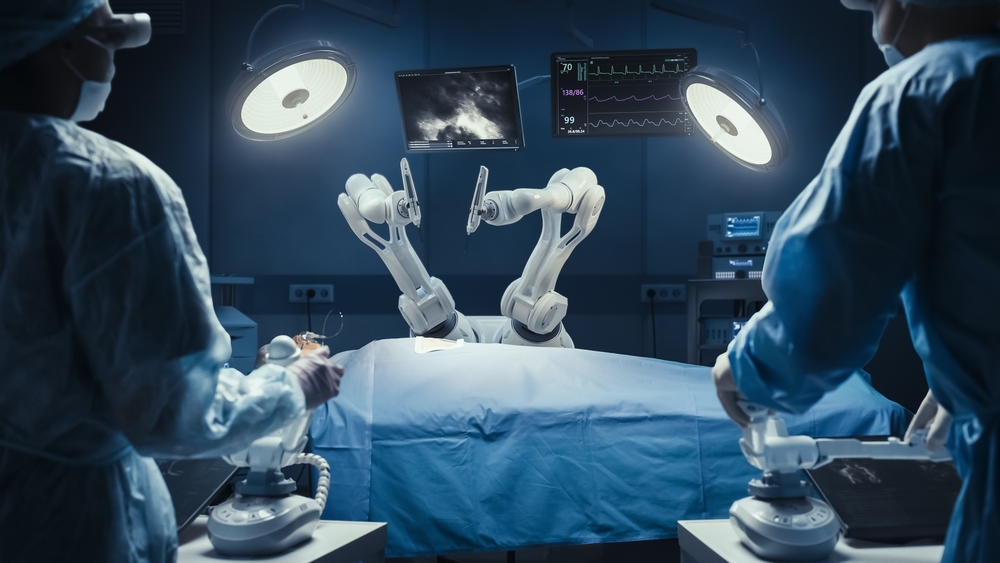

Robotic surgery has moved from cutting-edge to commonplace. The question is no longer whether to use robotics but when to introduce it and how to ensure adoption is efficient, affordable, and seamless for surgical teams. Ambulatory surgery centers (ASCs) are increasingly adding robotics to their service lines, driven by the…

Editor's Note Hospitals, physicians, and private equity are accelerating their push into lower-cost outpatient care. According to Colliers US Healthcare Services Research Report Q3 2025, published on September 22, ambulatory surgery center (ASCs) procedure volumes are projected to grow 9% between 2023 and 2028—outpacing hospital outpatient department growth at 7%—and…

Editor's Note Physician independence continues to decline as hospitals, insurers, and private equity firms expand their ownership of medical practices, according to a US Government Accountability Office (GAO) report published on September 22. The report found that 47% of physicians were employed by or affiliated with hospital systems in 2024,…

Editor's Note Private equity is driving a quiet but powerful transformation in the $30 billion ambulatory surgery center (ASC) market, heightening risks of higher costs and reduced competition, an October 2025 research brief from the Private Equity Stakeholder Project (PESP) reports. It warns that Wall-Street-backed consolidation and opaque ownership structures…

Editor's Note A growing subset of cosmetic surgery chains, some backed by private equity, have been named in multiple lawsuits alleging serious patient harm, according to an August 1 article in KFF Health News. Based on a joint investigation with NBC News, the outlets reports that chains offering body-reshaping operations…

Editor's Note Hospital-employed physicians are least likely and private equity (PE)-affiliated physicians most likely to provide care in lower-cost ambulatory surgery centers (ASCs) or offices, according to a study published July 24 in the Journal of Market Access & Health Policy These care site differences translate to substantial variation in…

Editor's Note Private equity ownership drives up colonoscopy prices without delivering better patient outcomes, according to a large retrospective analysis. While independent and private equity-acquired gastroenterology practices show no significant difference in quality, prices at private equity practices rose sharply, especially in highly consolidated markets. The study, published in JAMA…

Editor's Note Oregon has enacted the nation’s strictest law yet to curb corporate control of physician practices, a move that could indirectly affect office-based surgery (OBS) centers structured as medical clinics. As reported by Modern Healthcare on June 13, the new law reinforces the state’s corporate practice of medicine doctrine…

Editor's Note Two major players in outpatient surgical care are taking sharply different paths: Surgery Partners is rejecting a buyout bid, while Ascension is making a bold acquisition to rapidly expand its ambulatory surgery center (ASC) footprint. Surgery Partners has formally declined a takeover proposal from Bain Capital, Ambulatory Surgery…